Headquarters

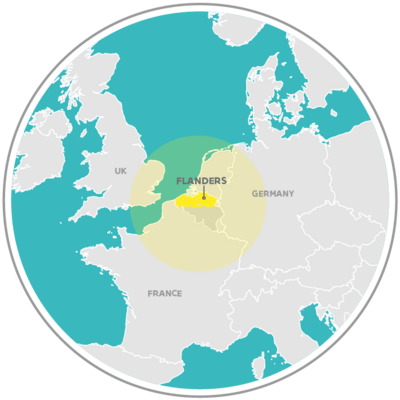

Interested in giving your investment project that extra boost it needs to thrive in today’s dynamic market? Look no further than Flanders to set up your European HQ and discover the best real estate and rental prices, the most advanced transportation network and some of the most loyal and productive personnel in the world.

Setting up your business: steps and instructions

Intrigued by all the great things you’ve been hearing about Flanders? These scenarios will help you get started on the path to opening up your new corporate headquarters in the region.

- Scenario 1: Representation office

- Scenario 2: Principal branch

- Scenario 3: Regional HQ or shared service center

- Scenario 4: Holding company

- Scenario 5: Central entrepreneur

Favorable prices

According to the Financial Times’ fDI Intelligence, investors have access to higher quality real estate at a lower cost compared to many other locations. Most locations at similar costs, such as Amsterdam, Lille and Warsaw, are not nearly as high quality.

Compared to other regions and countries in Europe and around the world, Flanders offers businesses affordable office space rental prices. In terms of occupancy price, Brussels – the capital of Flanders – scores significantly lower than nearby cities like London, Paris, Frankfurt. Moreover, Antwerp and Ghent – Flanders’ largest cities – offer the lowest rental prices per square meter compared to popular nearby cities.

Multilingual, top-class staff

Flanders’ highly skilled and motivated workforce will significantly streamline operations at your corporate headquarters. Workers of the region are known around the world for their multilingualism, loyalty and cross-border flexibility.

Workers of Flanders combine technological or scientific know-how with strong entrepreneurial skills, the result of an exceptional educational system that stresses practical applications and cutting-edge fields of study. In addition, modern regulatory infrastructure and flexible labor laws ensure that few days are lost to industrial disputes.

To top it all off, Flanders’ workforce is the 4th-most productive in the world, according to the US Conference Board.

61% of companies base their public affairs office in Belgium – and Flanders as a region – or employ lobbying firms based in Brussels.

Excellent quality of living

In Flanders, high-quality housing can still be found at affordable prices. Expatriate families in the region find themselves in an ideal environment characterized by an exceptionally high standard of living, and spoiled for choice when it comes to first-class health care and education. In addition, Flanders’ quality of life equals plenty of great opportunities for leisure and relaxation for you and your expat employees.

Tax incentives for businesses in Flanders

Flanders offers numerous tax advantages for businesses looking to establish operations in the region. The region has been committed for several decades to breaking down as many barriers to foreign investment as possible. Since Belgium began actively attracting multinationals to establish headquarters in Flanders through various incentives, approximately 2,300 foreign companies have set up offices right here in the heart of Europe.

Notional interest deduction

The notional interest deduction allows companies to reduce their taxable bases when making investments using their own resources. It is the deductible amount equaling the fictitious interest cost on the adjusted equity capital. The notional interest rate for financial year 2019 is 0.746% (1.246% for SMEs).

Tax treaty network

Companies located in Flanders have access to an excellent double tax treaty network of almost one hundred countries, including the US and big markets in Africa and Asia. Through these treaties, countries align their mutual tax policies to avoid international double taxation.

Expatriate status for foreign executives

Foreign nationals working in Belgium to manage subsidiaries, or those that have special expertise necessary to the company, can benefit from a special tax status. The same applies to foreign researchers that work in R&D departments.

Advantages for holding companies

Flanders has a long tradition of attracting holding companies. Apart from tax treaties, incentives for holdings in the region include:

- no capital duties, stamp duties or taxes on net value;

- no capital gains tax on shares (if certain conditions are met);

- a full tax exemption on received dividends;

- an exemption on withholding taxes for dividends paid to qualifying parent companies in treaty jurisdictions;

- an exemption on withholding taxes for interest paid by qualifying holding companies (in addition to numerous other exemption possibilities);

- tax deductibility of interest on the acquisition of shares (if certain conditions are met);

- application of a foreign functional currency for accounting purposes

IP and R&D incentives

Investors in Flanders benefit from a number of incentives for research and development as well as intellectual property management, including:

- the innovation income deduction, providing an 85% tax exemption of qualifying net IP income;

- the R&D investment deduction and R&D tax credit;

- an 80% exemption of professional withholding tax for employing scientific researchers and engineers;

- direct government grants for R&D and innovative projects.

Legal certainty: business-minded ruling practice

An advance ruling can be obtained, giving you the necessary certainty on the application of specific incentives, or the tax implications of a certain transaction or structure. In general, this unilateral written decision – made by the Belgian tax authorities at the request of a (potential) taxpayer – is valid for five years and renewable.

Indirect tax aspects

The main indirect taxes in Flanders are Value Added Tax (VAT) and customs duties. VAT is generally due on all sales and purchases, while customs duties apply to goods imported into Belgium from countries outside of the EU. To facilitate international trade, various incentives exist:

- VAT grouping – exemption from VAT as well as VAT deduction optimization of transactions between the different member companies of a corporate group;

- Import VAT deferment license or ET 14000 license – a free license that allows you to defer the payment of import VAT to the VAT return, resulting in cash flow advantages;

- VAT and customs warehouses – enabling trade to be exempt from VAT and or customs duties.